The Revenue Department Invites Taxpayers to Take Advantage of the Easy E-Receipt 2.0 Tax Benefits

The Revenue Department Invites Taxpayers to Take Advantage of the Easy E-Receipt 2.0 Tax Benefits

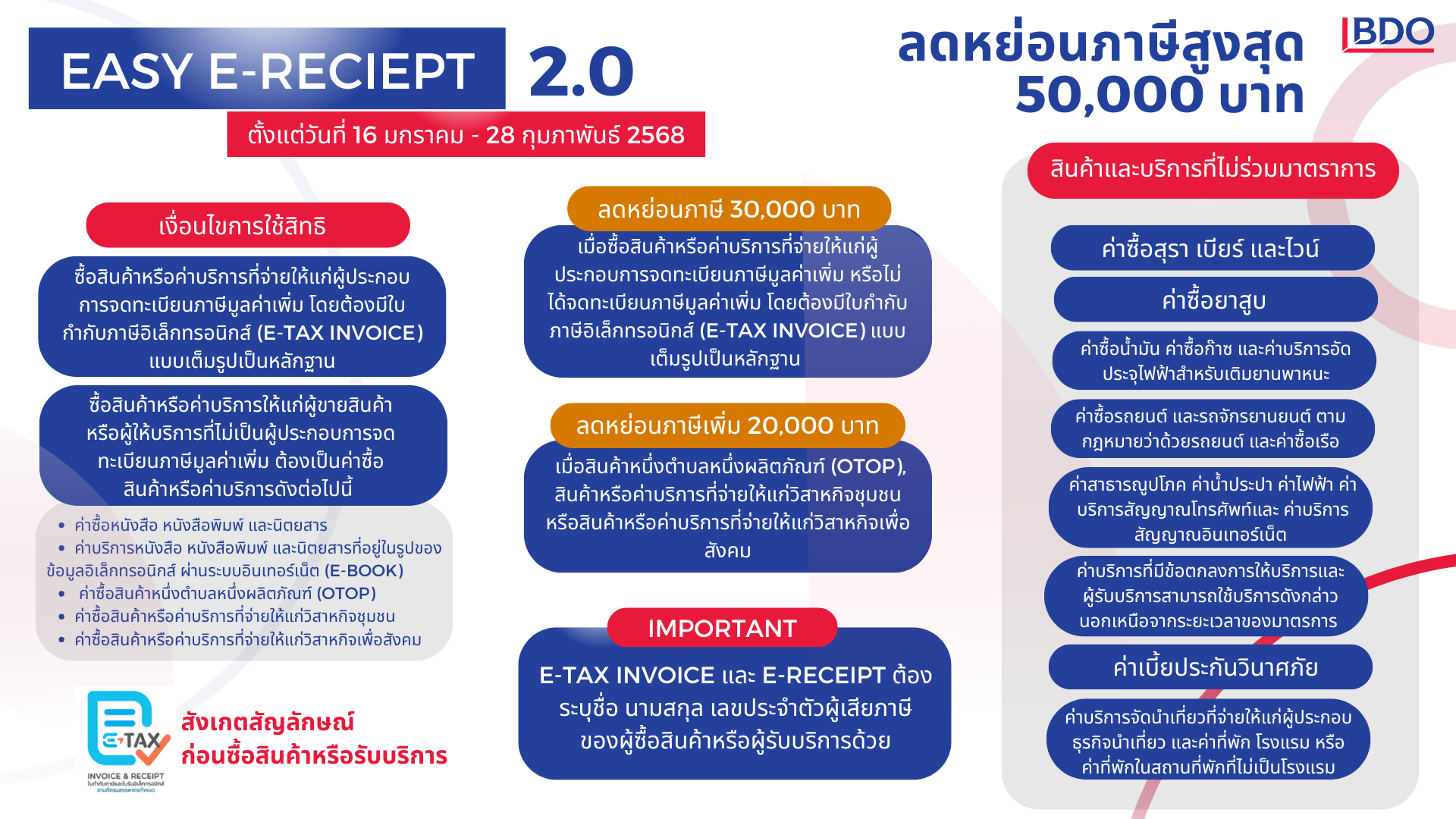

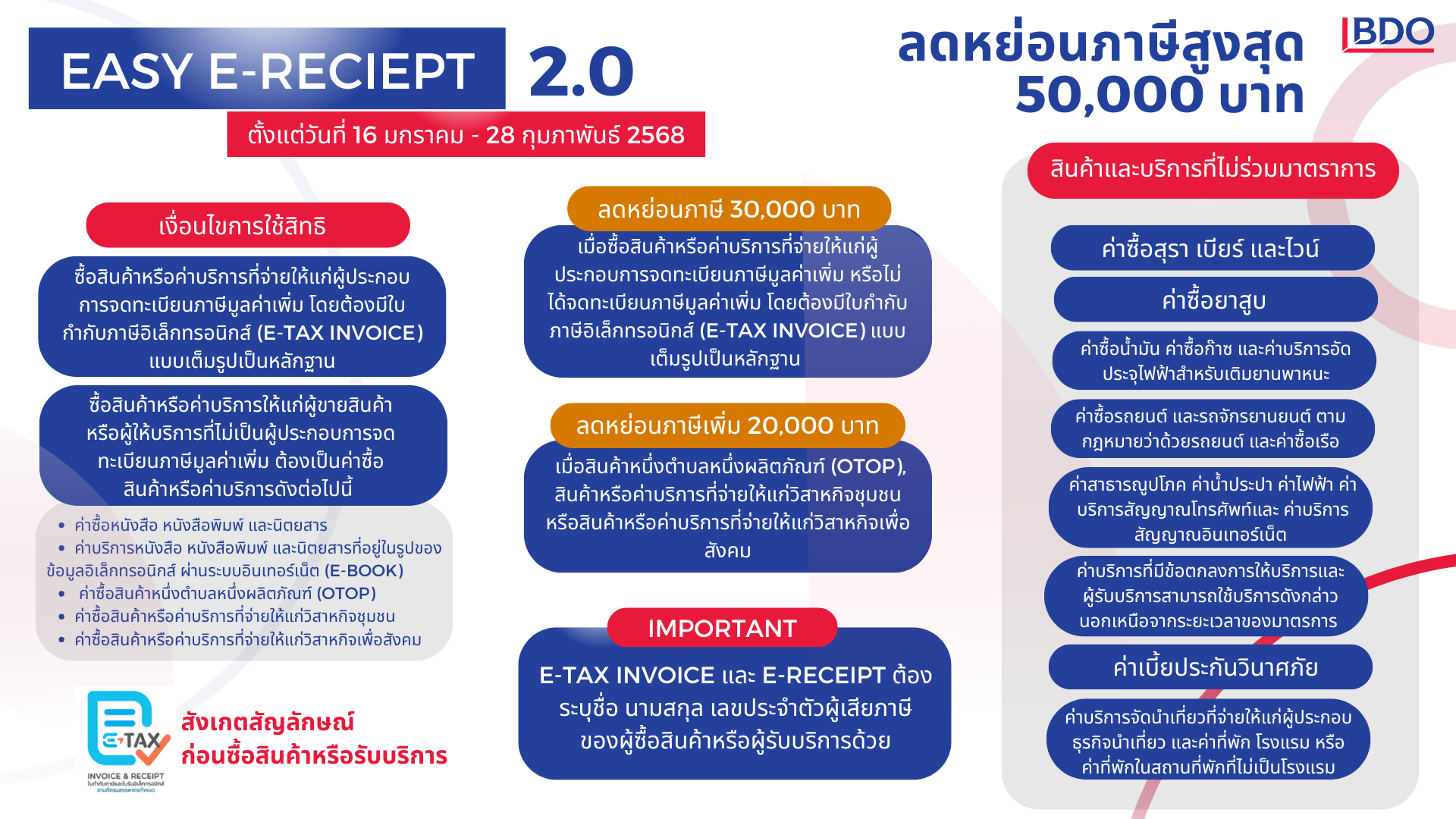

The Revenue Department invites taxpayers to take advantage of the tax deduction benefits offered under the Easy E-Receipt 2.0 initiative. This measure is designed to stimulate the economy through domestic spending and promote the use of electronic systems. It allows personal income taxpayers to deduct the cost of goods or services purchased between January 16, 2025, and February 28, 2025, as a tax allowance. The eligible purchases must meet the prescribed conditions and can be deducted up to the actual amount spent, with a maximum limit of 50,000 baht. However, taxpayers must obtain either an e-Tax Invoice or an e-Receipt, with the correct name and tax ID, as proof of their expenditures.